So the Co. is engaged in manufacturing of textiles from last 118 years. It’s again focusing and reshaping it’s structure for poised further growth.

Mafatlal industries is into manufacturing garments/ fabrics for men and women, upholstery items, uniforms for schools, corporate houses, and personal hygiene among others. the theme of personal hygiene has been focused after the covid-19 which gave the company a new direction among the players out there.

Drstockss loved about the co. is a great asset light model with outsourcing it and digitally foraying into the segments of key strength.

Global and sectoral outlook :

The global economy has witnessed uncertain times with geopolitical uncertainty, lingering supply chain disruption, a high inflationary scenario, spikes in commodity prices, and unexpected failures of major banks. It remains entangled between the cross-currents of slowing growth and high inflation.

The textile sector is one of the oldest industries in India, employing around 45 Million workers, including

3.5 Million handloom workers. The country enjoys a competitive edge in the global textile market, owing to its diverse production base, encompassing a wide range of fibers and yarns. These include natural fibers like cotton, jute, silk and wool, and synthetic/man-made fibers like polyester, viscose, nylon, and acrylic

In addition, the Government’s increased allocations and reforms aim to bolster the textile sector.

Industry outlook :

The rising per capita income as a result of strong economic growth contribute to higher discretionary

spending, which augurs well for the growth of technical textiles in general and health & hygiene products

in particular. In this segment as well, many state governments allocate funds consistently to promote

awareness about personal hygiene, especially feminine hygiene. This allocation of funds generates a good

demand for these products. Personal care & hygiene is a 1.12 Lakhs Crores market in India, and this product space is expanding significantly with the increase in e-commerce adoption and last-mile access to consumer.

Additionally, the anticipated rise in per capita income of the country is expected to set off a positive domino effect, particularly benefiting the education sector, leading to an increased demand for smart learning solutions. Thereby, holding the potential to have cascading effects on other sectors, including hygiene and FMCG.

The Indian Government has increased its focus and budgetary allocation in the education sector. For 2023-24, the net grant under the union budget has increased by ~17% to ` 68,804/- Crores. Under the Samagra Shiksha Scheme, state governments and UTs will be provided assistance in developing (Information and Communication Technology) ICT labs, digital content, and smart classrooms. Already in July 2022, ICT labs for 1,20,614 schools, smart classrooms for 82,120 schools, and 14,82,565 tablets for teachers have been approved and sanctioned.

Financials :

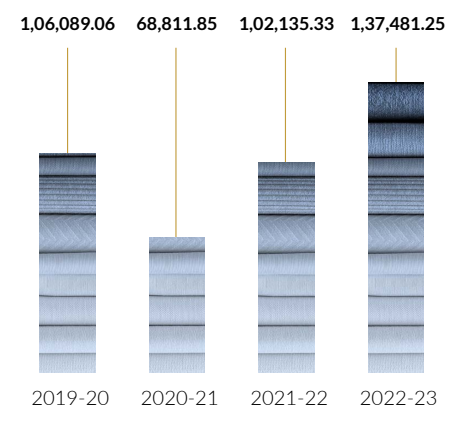

Total expenses and revenue – Revenue grew by 33% in the year 2022-23, increasing from ₹1,06,376 Lakhs in the previous year to₹ 1,41,562 Lakhs. the table below shows expenses.

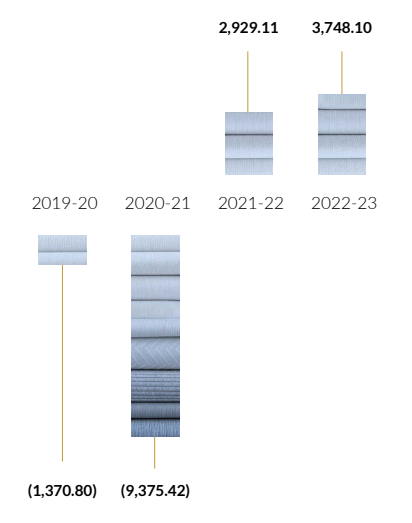

Total profit after tax – Profit after tax increased to ₹ 3,748 Lakhs in the year 2022-23, from ₹ 2,929 Lakhs in

the previous year.

Clientele :

The company caters to global brands like Jack & Jones, Wrangler, Lee, and C&A and domestic brands like Killer, Mufti, Spykar, and Allen Solly. Government and Institutions forms ~50% of the total customers

Drstockss outlook :

The company enjoys it’s goodwill through various internal links and also through, now govt. PLI schemes and other schemes for public beneficiaries will directly or indirectly benefit the mafatlal Ind. The company can grow at an avg of 18-20% forwarding to 2030 and one thing to notice is that co. holds 15% equity stake in NOCIL Ltd, and has 633 crores of investment as of march 2022.

With all this the uncovered potential can ring a bell at anytime.