Punjab Alkalies & Chemicals ( primo chemicals )

PENNY STOCK CASE STUDY

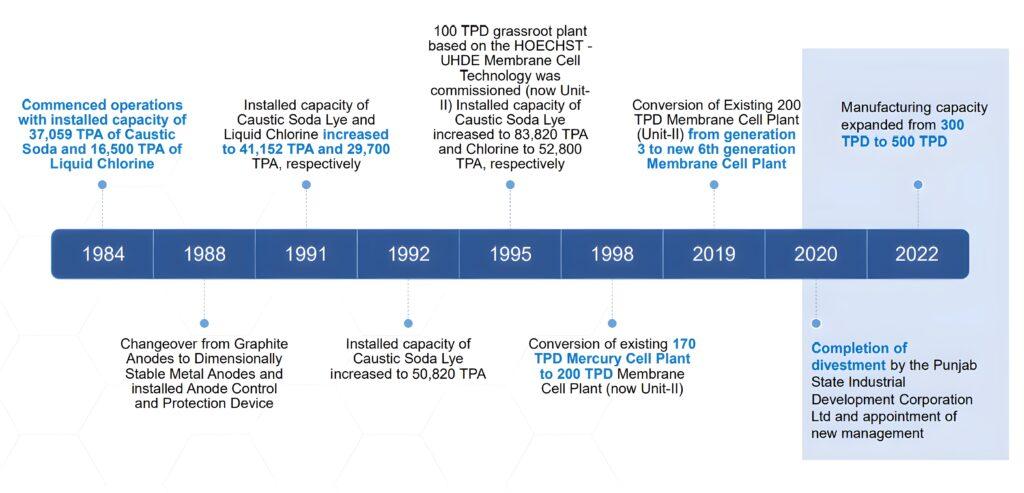

The Company was incorporated on 1st December 1975 and the name was changed to Punjab Alkalies & Chemicals Limited on 19th April 1983. The company’s main product is Caustic Soda Lye and it is the largest producer of Caustic Soda in the North India region. The by-products of the company are Hydrochloric Acid, Liquid Chlorine, Sodium Hypochlorite, and Hydrogen gas.

CMP- 85

- ROCE 39.0 %

- ROE 30.6 %

▪ PACL runs two manufacturing plants in Nangal, Punjab based on membrane cell technology with a capacity of

1,65,000 TPA (100% basis)

▪ Experience of over four decades in chemicals manufacturing with 340+ employees at present

▪ Diversified clientele base across India with capacity expansion planned in phases

▪ PACL was divested by Punjab State Industrial Development Corporation Ltd in Sept 2020 through an open offer

▪ New Products to be launched: Caustic flakes, Stable bleaching powder (SBP), Aluminium chloride and

Hydrogen Peroxide

▪ Commissioning of SBP plant by Q3 FY23

▪ Commissioning of Caustic flakes plant by Q4 FY23

▪ Commissioning of Aluminium Chloride plant by Q4 FY23

▪ Hydrogen Peroxide plant is under pipeline

▪ Environmental clearance awaited for Paracetamol API manufacturing plant as part of forward integration

strategy consuming PACL product such as Caustic Soda, Chlorine, Hydrochloric acid and Hydrogen gas

- Global Market Outlook

• The global caustic soda market is all set to

reach 87.3 million metric tons by 2027

• Supply constraints due to underutilization of

capacities globally led by high energy costs

and slow down in construction activities

• In 2023, chemical industry executives will

need to find the balance between navigating

ongoing crisis and challenge and positioning

for longer-term growth with technological

innovation, evolving customer preferences,

and supply chain resilience

• Despite the challenges, the industry is well

placed to lead the coming transformation that

will substantially alter chemicals businesses

and adjacent businesses in the decade ahead

Attractive Industry Dynamics

Price & Raw Material Dynamics

• Prices of Caustic Soda are influenced by

international prices as well as domestic

demand supply factors

• Chlor-Alkali Industry is power-intensive

industry

• PACL’s power costs account for about 60%

of its total cost of production

• PACL has completed purchaseof 49% stake in Flow TechChemicals Private Limited, a related party, as on 30th June,

2022 wiith Cash Consideration Rs. 530 million. The Flow Tech Chemicals Engaged primarily in the manufacturing of

chlorinated paraffin (CP) (awidely used plasticizer) and hydrochloric acid . Flowtech is one of the major customer of chlorine

therefore,

PACL is highly dependent on Flowtech for utilization of chlorine and continuity of its operations.

IT will result in inhouse chlorine consumption, consistency and better control leading to increased production of caustic soda lye Enhanced control and optimization of manufacturing process, Lower transportation Cost and turnaround times due to location proximity and Incremental Revenue Growth.

Company’s journey

Our Outlook

Looking at current market scenario and global macro’s the company is poised for an exponential growth and we are extremely bullish as it completes our biassed research onto the whole sector. Coming onto the outlook we maintain a buy position with almost 100% upside potential.

DO APPLY DUE DILIGENCE

Subscribe for insights and newsletter from our research analysts and more.